Profit and Loss Formula

By applying the following formula we obtain our NOI net operating income or EBITDA Earnings Before Interest Taxes Depreciation Amortization. A profit loss statement can be prepared by a bookkeeper accountant or accounting software like Quickbooks.

How To Find Profit And Loss Calculate Profit And Loss Using Formula Youtube Profit And Loss Statement Small Business Bookkeeping Profit

Add this column to keep an eye on how the financial year is tracking.

. Every product has a cost price and a selling price. Let us learn in this article how to calculate the profit amount and percentage with the help of formulas and related topics. There are several factors to consider in a PnL.

The Bitcoin Profit App software will scan and analyze the market searching for trading opportunities that match your trading parameters. Profit and Loss Percentage Example. The gross profit margin reflects how.

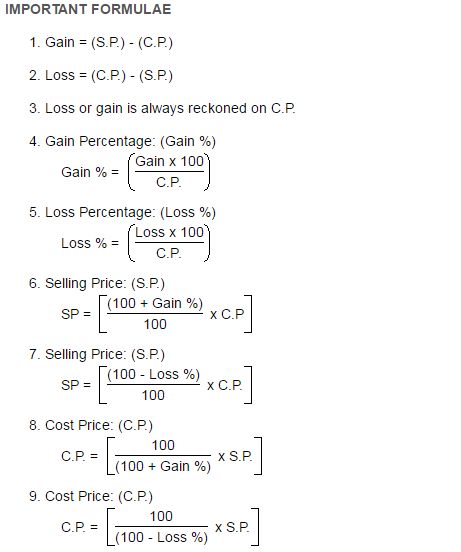

Formula to calculate cost price if selling price and profit percentage are given. It is computed as the residual of all revenues and gains less all expenses and losses for the period. Profit profit cost price x 100 and Loss loss lost price x 100.

Formula to calculate cost price if selling price and loss percentage are given. Deadweight Loss ½ IG HF. 65 of CP.

Below is the required implementation. The stop loss and take profit limits and more. The software will use the parameters to find trading opportunities in.

Statement of Profit and Loss Formula. There is a cost price and a selling price for any product. Profit and Loss Percentage Formula from Cost price and Sell Price.

The result of its profit formula is. The profit and loss formula is a mathematical formula that is used to calculate the selling price of a product and to determine how profitable a company is. Gross Profit Margin.

The gross profit formula can also be used to calculate your gross profit margin. It is computed as the difference between the total sales revenue and the overall expenses incurred by the company. Is it the condition of profit or loss.

If an article is sold at a loss of say 35 then SP. A business generates 500000 of sales and incurs 492000 of expenses. Profit formula is obtained by subtracting selling price with the cost price.

How to Create a Profit and Loss Statement. Gross profit margin is a measure of profitability that shows the percentage of revenue that exceeds the cost of goods sold COGS. Any financial benefit gained in business goes to the owner of the business.

Again the formula for profit per unit can be derived by deducting the cost price of production from the selling price of each unit as shown below. Rs 350 SP - Rs 700. The concept of profit and loss is basically defined in terms of business.

If an article is sold at a gain of say 35 then SP. The gross profit margin is a good way to measure your businesss production efficiency over time. In business and accounting net income also total comprehensive income net earnings net profit bottom line sales profit or credit sales is an entitys income minus cost of goods sold expenses depreciation and amortization interest and taxes for an accounting period.

From the profit and loss Mathematics formula Profit SP - CP. Net Income Revenues Gains Expenses Losses 1. It should be noted that the profit and loss as a percentage is generally used to depict how much profit or loss a trader gets from a.

Gross Profit Net Sales Cost of. 1 Whereas gross profit is a dollar amount the gross profit margin is a percentage. If you look at the above example of profit and loss statement the total of direct income is reduced by direct expenses to arrive the gross profit.

Profit ProfitCP 100. Relevance and Use of Deadweight Loss. Finally the formula for profit can be derived by subtracting the total expenses step 2 from the total revenue step 1 as shown below.

A profit and loss statement enables professional financial analysts to make recommendations about financial health of a company and whether to invest or acquire that business. First click on cell E5 and type the following formula. The profit percentage or loss percentage is calculated with the help of the following formulas which show that the profit or loss in a transaction is always calculated on its Cost Price.

You may also see PL statement referred to as your hotel income statement profit and loss report statement of financial results income and expenses statement or statement of profit and loss. Find his overall profit. The profit formula is stated as a percentage where all expenses are first subtracted from sales and the result is divided by sales.

Access common formats and custom reports. We may measure the profit or loss made for a specific product based on the values of these prices. We sometimes lose too.

Year to date column. Run the Profit and Loss report to view your income expenses and profit for the selected report period. If a suitable opportunity presents itself the software will go ahead and open a trade.

SP Rs 700 Rs 350 Rs 1050. 135 of CP. It should be noted that when the selling price is less than the cost price there is a loss in the transaction.

Deadweight Loss ½ Price Difference Quantity Difference. Example of the Profit Calculation. Find the profit percentage and loss percentage by using the formula.

Example of Profit and Loss Statement. Sales - Expenses Sales Profit formula. Profit is explained better in terms of cost price.

Profit SP - CP 900 800 100. CP SP 100 100 percentage loss. Raj purchased a bike for Rs.

Finding the Profit Percent Loss Percent. Finally the formula for deadweight loss is expressed as the area of the triangle with base equivalent to price difference step 5 and height equivalent to quantity difference step 4 as shown below. Below is the example of a profit and loss statement of Max Electronics for the current financial year 2020-21.

Thus the selling price is Rs 1050 if the profit is 50 of the cost price. Note- It is to be strictly noted that the Profit or Loss percentage is always calculated on the Cost Price of an item until and unless it is mentioned to calculate the percentage on Selling Price. CP SP 100 100 percentage profit.

In this method we will use the mathematical formula subtraction to simply get the result of profit or loss and then use percentage formatting from the Number Format ribbon. Profit and Loss formula is used in mathematics to determine the price of a commodity in the market and understand how profitable a business is. If the CP of a commodity 800 and SP 900 then lets find the profit.

Regardless of the industry each example of a profit and loss statement the statement of profit and loss format involves five main sections. Profit Formula Profit Formula The profit formula evaluates the net gain or loss of an organization in a particular accounting period. The important terms covered.

Profit Total Sales Total Expense. 2 A shopkeeper bought two TV sets at Rs 10000 each such that he can sell one at a profit of 10 and the other at a loss of 10. Money is not always synonymous with gain.

Visit BYJUS to know about all formulas for profit like profit percent formula gross profit formula etc. When a person sells two similar items one at a gain of say x and the other at a loss of x then the seller always incurs a loss given by. The profit formula helps in calculating the profit earned by selling a particular product usually in a business or to calculate the gain in any financial transaction.

75000 and he sold it for Rs55000. Then you can add a formula column so you can choose which columns to include in the total. Based on the values of these prices we can calculate the profit gained or the loss incurred for a particular product.

Profit And Loss Formulas By Bhumika Agrawal Studying Math Maths Formula Book Basic Math Skills

Profit And Loss Rs Aggarwal Class 8 Maths Solutions Ex 10a Http Www Aplustopper Com Profit Loss Rs Aggarwal Cla Maths Solutions Math Methods Math Formulas

Profit And Loss Basics And Methods Examples Math Tricks Math Tricks Math Profit

Profit Loss Profit And Loss Important Formulas Youtube Math Methods Free Math Centers Profit And Loss Statement

Profit And Loss Formulas By Bhumika Agrawal Studying Math Maths Formula Book Basic Math Skills

Profit And Loss Rs Aggarwal Class 8 Maths Solutions Ex 10a Http Www Aplustopper Com Profit Loss Rs Aggarwa Maths Solutions Math Methods Math Formula Chart

Comments

Post a Comment